Carbon Steel Tubing Market Growth CAGR Overview

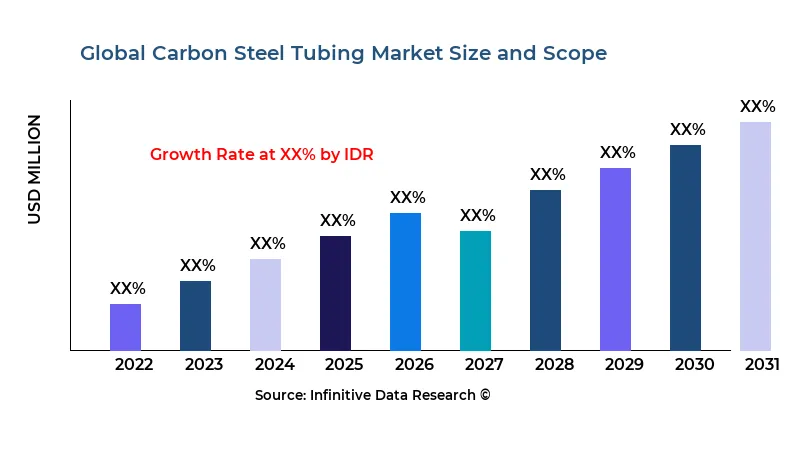

According to research by Infinitive Data Research, the global Carbon Steel Tubing Market size was valued at USD 84.95 Bln (billion) in 2024 and is Calculated to reach USD 94.85 Bln (billion) by the end of 2032, growing at an anticipated compound annual growth rate (CAGR) of 2.04% during the forecast period 2024 to 2032. This projected growth is driven by its increasing adoption across Chemical & Materials industries such as Automotive, Industrial, Household Equipment, OtherThe carbon steel tubing market is closely linked to energy-sector investments, especially oil & gas pipelines and well-completion applications. Fluctuating crude-oil prices dictate upstream exploration budgets, which in turn drive tubular-goods demand. In mature basins, replacement and remediation work sustains stable consumption, while frontier developments spur new orders. Manufacturers often customize tubing grades (e.g., J55, N80) to meet varying well-depth and corrosion-resistance requirements.

Automotive and mechanical engineering sectors rely on carbon steel tubes for chassis components, hydraulic lines, and exhaust systems. Lightweighting trends are stimulating the use of thinner-wall tubing with higher-strength grades, forcing mills to adopt advanced cold-drawing and annealing processes. Supply-chain resilience is paramount: just-in-time deliveries minimize inventory costs for OEMs, leading tubing producers to establish regional processing hubs near auto clusters.

Building & construction applications—including scaffolding, structural supports, and furniture—represent a steady, if lower-margin, segment. Tubing producers balance production between large-diameter line pipes and small-diameter mechanical tubes, optimizing mill runs to maximize yield. Quality-control standards such as ISO 3183 and ASTM A53 are critical for charters across end-use industries.

Industrial equipment manufacturers, including hydraulic-cylinder and heat-exchanger producers, demand precise tolerances and surface finishes. Seamless tubing commands higher premiums compared to welded counterparts due to superior pressure integrity. Investment in induction bending and precision-cutting equipment enhances a producer’s ability to offer value-added services, deepening customer relationships.

>>> Understand The Key Trends Shaping This Market:- Download PDF Sample

Carbon Steel Tubing Market Growth Factors

Global infrastructure modernization—spanning water pipelines, district heating, and industrial utilities—bolsters demand for carbon steel tubes. Public spending on municipal water systems and heating networks, particularly in Europe and Asia, translates into long-life tubular assets. Producers with robust fabrication and coating capabilities capture a larger share of these long-cycle projects.

The rebound of oil & gas exploration following pandemic-era cutbacks has revived tubular-goods markets. Deep-water and unconventional plays require specialized tubing grades and premium connections. Services companies and drillers negotiate framework agreements with tubing mills to lock in prices and ensure delivery reliability over multi-year programs.

Automotive sector electrification has mixed impacts: while EVs reduce exhaust-tube demand, hydraulic-tube needs persist in braking and steering systems. Simultaneously, growth in commercial vehicles and off-highway equipment continues to underpin mechanical-tube consumption. Tubing mills are diversifying into specialty alloys and hybrid materials to offset declines in legacy segments.

Advancements in downhole-tubing technology, such as corrosion-inhibitor linings and high-pressure, high-temperature (HPHT) grades, create niche high-margin opportunities. Tubular goods suppliers with R&D capabilities to develop proprietary coatings and premium connections can command premiums up to 30 % above standard grades. Strategic licensing agreements further monetize these innovations.

Market Analysis By Competitors

- AK Steel

- TimkenSteel

- Zekelman Industries

- Tenaris

- Sandvik Materials Technology

- EMJ Metals

- Russel Metals

- Webco Industries

- JFE Steel(Chita Works)

- Midwest Tube Mills

- Sharon Tube

- Vallourec

- Accu-Tube Corporation

By Product Type

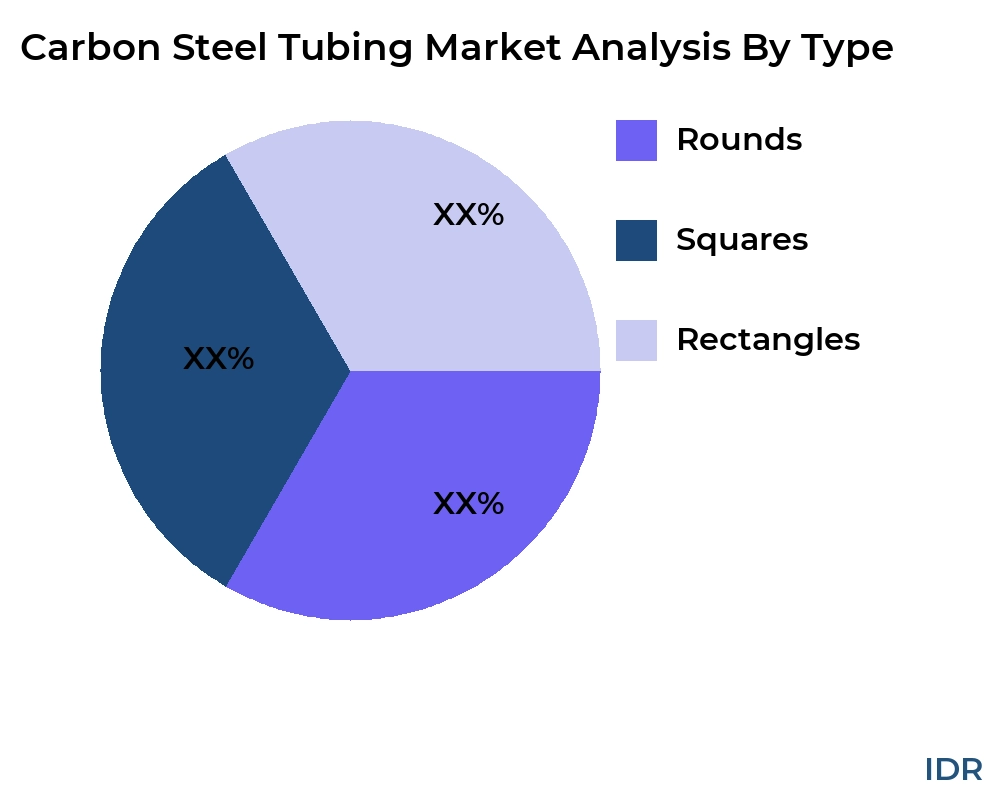

- Rounds

- Squares

- Rectangles

By Application

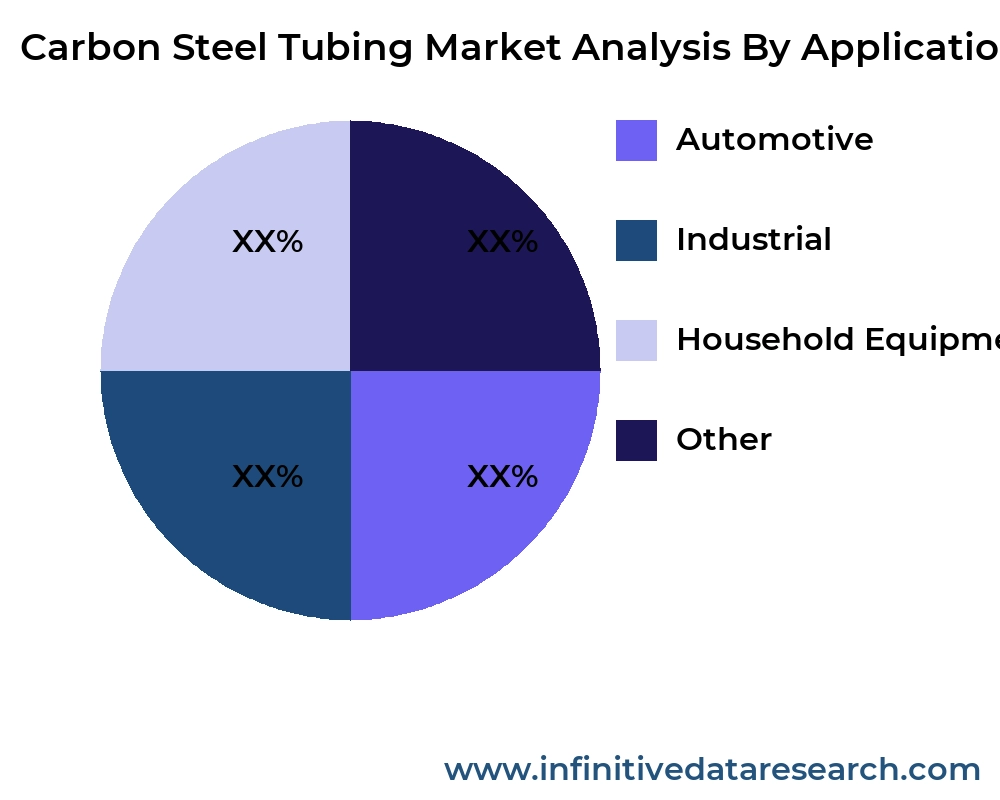

- Automotive

- Industrial

- Household Equipment

- Other

>>> Understand The Key Trends Shaping This Market:- Understand The Key Trends Shaping This Market:-

Carbon Steel Tubing Market Segment Analysis

Distribution Channel: Carbon steel tubing is sold via direct contracts with EPC (engineering, procurement, construction) firms for large-scale projects and through distributors/service centers for small-batch orders. Distributors provide inventory stocking, cut-to-length services, and minor fabrication, while direct contracts often include in-field support and logistics management.

Compatibility: Tubing must comply with industry standards—ASTM A53, API 5L, EN 10217—to ensure interoperability with fittings, valves, and welding procedures. Seamless tubing is preferred for high-pressure, critical-service applications, whereas electric-resistance-welded (ERW) tubes serve general mechanical and structural uses. Tubing producers offering multiple compliance certifications enjoy broader market access.

Price Range: Seamless tubing commands a premium of 15–25 % over ERW products due to higher production costs. High-alloy grades (e.g., chrome-molybdenum) carry additional markups of 30–50 %. Price volatility in raw-material inputs (primarily hot-rolled coil and plate) leads to pass-through surcharge mechanisms in long-term supply agreements, protecting mill margins.

Product Type: The market divides into seamless, ERW, and submerged-arc-welded (SAW) tubes. Seamless tubes lead with approximately 40 % share due to superior mechanical properties. ERW tubes, accounting for 35 %, are cost-effective for lower-pressure applications. SAW tubes serve large-diameter line-pipe segments, capturing the remaining share. Each type requires distinct mill capabilities and process controls.

| REPORT ATTRIBUTES | DETAILS |

|---|---|

| Study Period |

2019-2032 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Period |

2019-2022 |

| Unit |

Value (USD Billion) |

| Key Companies Profiled |

AK Steel, TimkenSteel, Zekelman Industries, Tenaris, Sandvik Materials Technology, EMJ Metals, Russel Metals, Webco Industries, JFE Steel(Chita Works), Midwest Tube Mills, Sharon Tube, Vallourec, Accu-Tube Corporation |

| Segments Covered |

By Product |

| Customization Scope |

Free report customization (equivalent to up to 3 analyst working days) with purchase. Addition or alteration to country, regional and segment scope |

>>> Overview of Market Analysis:- Download PDF Sample

Carbon Steel Tubing Market Regional Analysis

Asia-Pacific is the largest regional market, underpinned by China’s vast pipeline network expansions and India’s manufacturing growth. Southeast Asian nations are investing in petrochemical‐ and power-plant projects, further driving tubular goods demand. Local tubing mills benefit from low-cost feedstocks and supportive government incentives.

North America’s market is rejuvenated by shale-gas developments and petrochemical facility expansions along the U.S. Gulf Coast. Tubing producers near Houston and Midland, Texas, serve fracking and offshore markets. U.S. mills also supply automotive tubular components from plants located in the Midwest auto corridor.

Europe represents a stable market with modest growth, driven by renovation of heating networks and industrial plant turnarounds. Stringent environmental regulations favor tubing sourced from mills with low-carbon footprints. Imports from Eastern Europe and Turkey compete on price for commodity grades.

Middle East & Africa exhibits high volatility but significant upside potential. Gulf Cooperation Council countries are investing heavily in oil, gas, and petrochemical projects, leading to surges in line-pipe and coating-service demand. African markets are emerging, with infrastructure funding from multilateral agencies spurring water and energy projects that require robust tubing solutions.

global Carbon Steel Tubing market revenue (usd million) comparison by players 2024-2032

| Company/players | 2021 | 2022 | 2023 | 2024 | ... | (2032) |

|---|---|---|---|---|---|---|

| AK Steel | XX | XX | XX | XX | XX | XX |

| TimkenSteel | XX | XX | XX | XX | XX | XX |

| Zekelman Industries | XX | XX | XX | XX | XX | XX |

| Tenaris | XX | XX | XX | XX | XX | XX |

| Sandvik Materials Technology | XX | XX | XX | XX | XX | XX |

| EMJ Metals | XX | XX | XX | XX | XX | XX |

| Russel Metals | XX | XX | XX | XX | XX | XX |

| Webco Industries | XX | XX | XX | XX | XX | XX |

| JFE Steel(Chita Works) | XX | XX | XX | XX | XX | XX |

| Midwest Tube Mills | XX | XX | XX | XX | XX | XX |

| Sharon Tube | XX | XX | XX | XX | XX | XX |

| Vallourec | XX | XX | XX | XX | XX | XX |

| Accu-Tube Corporation | XX | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX | XX |

global Carbon Steel Tubing market revenue (usd million) comparison by product type 2024-2032

Product Type

2023

2024

...

2032

CAGR%(2024-32)

Rounds

XX

XX

XX

XX

XX

Squares

XX

XX

XX

XX

XX

Rectangles

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Product Type | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Rounds | XX | XX | XX | XX | XX |

| Squares | XX | XX | XX | XX | XX |

| Rectangles | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

global Carbon Steel Tubing market revenue (usd million) comparison by application 2024-2032

Application

2023

2024

...

2032

CAGR%(2024-32)

Automotive

XX

XX

XX

XX

XX

Industrial

XX

XX

XX

XX

XX

Household Equipment

XX

XX

XX

XX

XX

Other

XX

XX

XX

XX

XX

Total

XX

XX

XX

XX

XX

| Application | 2023 | 2024 | ... | 2032 | CAGR%(2024-32) |

|---|---|---|---|---|---|

| Automotive | XX | XX | XX | XX | XX |

| Industrial | XX | XX | XX | XX | XX |

| Household Equipment | XX | XX | XX | XX | XX |

| Other | XX | XX | XX | XX | XX |

| Total | XX | XX | XX | XX | XX |

>>> Market Understand Through Graph And Chart:- Download PDF Sample

Carbon Steel Tubing Market Competitive Insights

The carbon steel tubing market is moderately consolidated, with global leaders serving energy and industrial segments and local mills catering to construction and automotive demands. Technical expertise in premium-grade production differentiates top players from regional fabricators.

Capacity expansions are underway in Asia, where mills leverage low-cost input materials to achieve scale economies. Strategic joint ventures with engineering companies accelerate technology transfer and market access. In contrast, North American and European producers focus on value-added services—cutting, bending, threading—to offset higher manufacturing costs.

Sustainability considerations are emerging: mills offering tubes produced via electric-arc furnaces with scrap-input blends command preferential procurement for government-funded projects. Certification under ISO 50001 and participation in steel-decarbonization consortia bolster customer trust.

Price competition in commodity segments pressures margins, prompting mills to lock in feedstock through captive rolling-mill acquisitions or long-term scrap-supply agreements. Meanwhile, manufacturers push into adjacent offerings—such as coatings, heat treatment, and testing services—to deepen customer relationships and secure higher-margin revenues.

Carbon Steel Tubing Market Competitors

-

USA

-

Tenaris

-

U. S. Steel Tubular Products

-

Vallourec Tubes USA

-

JMC Steel Group

-

Wheatland Tube

-

-

China

-

Taigang Tube Co. (TPCO)

-

Tianjin Pipe Group

-

Zhejiang Steel Tube Co.

-

Beijing Tianlong Special Tube

-

Shanxi Taigang Stainless Steel

-

-

Germany

-

Benteler Steel/Tube GmbH

-

Salzgitter Mannesmann

-

Europipe GmbH

-

Mannesmann Gossler

-

Vallourec Deutschland

-

-

Japan

-

JFE Steel Tubes & Pipe

-

Sumitomo Pipe & Tube

-

Nippon Steel & Sumikin Tubes

-

Osaka Steel Co.

-

Yamanaka Special Tube

-

-

India

-

Jindal Saw

-

Ratnamani Metals & Tubes

-

Zenith Tubes

-

Surya Roshni Ltd.

-

Maharashtra Seamless Ltd.

-

-

South Korea

-

Hyundai Steel Tube Division

-

SeAH Precision Tube Co.

-

Dongkuk Steel Mill Co.

-

Vira Industries

-

STS Pipe & Tube Co.

-

Carbon Steel Tubing Market Top Competitors

Tenaris

Tenaris is a leading global supplier of premium tubular goods, serving oil & gas and industrial markets.

Its extensive sales network spans over 30 countries, with manufacturing plants on four continents.

Tenaris invests in R&D for proprietary connections and alloy developments, securing technology leadership.

The company emphasizes digital-field services—remote monitoring and predictive maintenance—for downstream customers.

Sustainability initiatives include electric-arc-furnace trials and water-recycling programs at key plants.

Long-term framework agreements with major operators underpin Tenaris’s revenue stability.

Vallourec

Vallourec specializes in high-value seamless tubes for energy and industrial applications.

Its global footprint includes integrated operations in France, Brazil, and the U.S. Gulf Coast.

The company offers a portfolio of proprietary coating and testing services, enhancing product differentiation.

Vallourec’s carbon-reduction roadmap targets net-zero steelmaking through hydrogen and CCUS pilot projects.

Strategic partnerships with drilling majors ensure aligned product development for deep-water applications.

While facing financial restructuring, Vallourec continues to invest in premium grade expansions.

Jindal Saw

Jindal Saw is India’s foremost tubular-goods manufacturer, producing seamless and ERW tubes.

The company caters to oil & gas, waterworks, and structural markets, with plants in India and the U.S.

Jindal Saw emphasizes vertical integration, with captive power and iron-ore mining securing costs.

Its coated-pipe division offers electro-fusion welding and composite linings for specialty projects.

Strong domestic infrastructure pipelines and export orders to the Middle East drive growth.

The firm’s high debt levels are being managed via asset monetization and equity infusions.

Benteler Steel/Tube

Benteler is a German-based manufacturer of cold-drawn seamless tubes, primarily for automotive and mechanical uses.

Its light-weight steel solutions align with OEM electrification strategies, reducing vehicle mass.

Benteler’s plants in Germany, Slovakia, and China enable cost-effective regional supply.

The company integrates R&D with automotive clients to co-develop next-gen tubing materials.

Lean production and digital-shopfloor initiatives deliver consistent quality and just-in-time delivery.

Benteler is expanding its green-steel portfolio via partnerships in scrap-based steelmaking.

Taigang Tube Co. (TPCO)

TPCO is China’s largest seamless-tube producer, serving domestic oil & gas and petrochemical sectors.

The company leverages state support for capacity expansions and technology upgrades.

TPCO’s product range includes high-alloy grades for deep-sea and high-temperature applications.

Its strategic location near major pipeline routes ensures rapid dispatch and low transport costs.

R&D efforts focus on sour-service steels compliant with NACE MR0175 standards.

Export growth to Middle East and Africa underpins TPCO’s international ambitions.

U. S. Steel Tubular Products

U. S. Steel Tubular Products is a subsidiary of United States Steel focusing on ERW and seamless tubing.

The division supplies line pipe and mechanical tubing to energy and construction clients across North America.

Recent mill modernizations improved manufacturing yield and reduced electric-arc-furnace energy usage.

Long-term contracts with federal pipeline programs provide order visibility through 2028.

The unit’s service centers offer coating and finishing options to meet project specifications.

U. S. Steel Tubular Products is integrating direct-reduced iron to lower carbon intensity.

JFE Steel

JFE Steel Tubes & Pipe unit produces seamless and welded tubes for oil & gas and automotive markets.

Its PINAVIA surface-finishing technology enhances weld quality and fatigue resistance.

JFE’s strategic alliance with NileDutch Shipping ensures efficient global logistics.

The company pilots hydrogen co-firing in its furnaces to reduce CO₂ emissions.

JFE’s tubes meet both API and JIS standards, broadening its international customer base.

High process automation ensures competitive costs despite Japan’s higher labor rates.

POSCO

POSCO’s tube division leverages the parent company’s advanced steel grades for premium tubing.

The plant near Pohang, South Korea, specializes in high-strength, corrosion-resistant seamless tubes.

POSCO’s RE–X (reduced environmental–X-steel) program aims for fossil-fuel reduction in smelting.

Regional distribution centers in North America support quick response to end-user needs.

The firm’s digital-order platform provides real-time stock visibility and order tracking.

POSCO’s commitment to circularity includes scrap-collection initiatives within its service network.

Nippon Steel

Nippon Steel’s Sumikin Tube & Pipe subsidiary supplies seamless and ERW tubes globally.

The company’s hydrogen reduction research targets a 30 % cut in blast-furnace emissions by 2027.

Nippon Steel offers value-added services—laser cutting, bending, and hydraulic testing—to OEMs.

Its high-alloy tubing grades serve power-plant and chemical-plant applications requiring creep resistance.

Long-standing relationships with Japanese drillers secure recurring orders.

Nippon Steel’s export strategy focuses on Southeast Asia and Oceania infrastructure projects.

Salzgitter Mannesmann

Salzgitter Mannesmann is a leading German tube producer for energy, automotive, and industrial markets.

Its Dillenburg mill specializes in large-diameter seamless line pipe and precision mechanical tubing.

The company employs advanced induction-heating techniques for precise wall-thickness control.

Sustainability initiatives include 100 % green electricity usage and scrap-based EAF trials.

Salzgitter provides turnkey solutions with on-site bending and welding services.

Its dual focus on commodity and premium grades allows agile response to market shifts.

The report provides a detailed analysis of the Carbon Steel Tubing market across various regions, highlighting the unique market dynamics and growth opportunities in each region.

- US

- Canada

- Mexico

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Brazil

- Argentina

- Rest of Latin America

>>> Need A Different Region Or Segment? Download PDF Sample

Key Takeaways

- The global Carbon Steel Tubing market is expected to grow significantly from 2024 to 2032, driven by technological advancements, increasing demand, and government investments in urbanization.

- The market is characterized by a diverse range of manufacturers, product types, and applications, catering to different consumer needs and preferences.

- Regional insights highlight the unique market dynamics and growth opportunities in various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- The competitive landscape features key players who have created a dynamic and diverse market environment through collaborations, mergers and acquisitions, and innovative product developments.

- Market trends such as technological advancements, sustainability, customization, and digital transformation are shaping the growth and development of the Carbon Steel Tubing market.

- Despite the positive outlook, the market faces challenges such as regulatory compliance, high initial investment costs, and economic uncertainties.

- The report provides comprehensive coverage of market size, market share, growth factors, and strategic insights to help businesses navigate the dynamic Carbon Steel Tubing market and achieve long-term success.

By leveraging the information provided in this report, businesses can develop effective strategies, address market challenges, and capitalize on growth opportunities to ensure sustainable growth and long-term success in the global Carbon Steel Tubing market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Currency

- Key Target Audience

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Carbon Steel Tubing Market Analysis and Projection, By Companies

- Segment Overview

- AK Steel

- TimkenSteel

- Zekelman Industries

- Tenaris

- Sandvik Materials Technology

- EMJ Metals

- Russel Metals

- Webco Industries

- JFE Steel(Chita Works)

- Midwest Tube Mills

- Sharon Tube

- Vallourec

- Accu-Tube Corporation

- Global Carbon Steel Tubing Market Analysis and Projection, By Type

- Segment Overview

- Rounds

- Squares

- Rectangles

- Global Carbon Steel Tubing Market Analysis and Projection, By Application

- Segment Overview

- Automotive

- Industrial

- Household Equipment

- Other

- Global Carbon Steel Tubing Market Analysis and Projection, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Switzerland

- Austria

- Belgium

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Vietnam

- Philippines

- Australia

- Thailand

- Singapore

- Rest of APAC

- Middle East

- UAE

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of MEA

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Global Carbon Steel Tubing Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Carbon Steel Tubing Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- AK Steel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- TimkenSteel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Zekelman Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Tenaris

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sandvik Materials Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- EMJ Metals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Russel Metals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Webco Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- JFE Steel(Chita Works)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Midwest Tube Mills

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sharon Tube

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Vallourec

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Accu-Tube Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Drivers of Global Carbon Steel Tubing Market: Impact Analysis

- Restraints of Global Carbon Steel Tubing Market: Impact Analysis

- Global Carbon Steel Tubing Market, By Technology, 2023-2032(USD Billion)

- global Rounds, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Squares, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Rectangles, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Automotive, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Industrial, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Household Equipment, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Other, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

List of Figures

- Global Carbon Steel Tubing Market Segmentation

- Carbon Steel Tubing Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Carbon Steel Tubing Market

- Top Winning Strategies, 2023-2032

- Top Winning Strategies, By Development, 2023-2032(%)

- Top Winning Strategies, By Company, 2023-2032

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Restraint and Drivers: Carbon Steel Tubing Market

- Carbon Steel Tubing Market Segmentation, By Technology

- Carbon Steel Tubing Market For Live Attenuated, By Region, 2023-2033 ($ Billion)

- Global Carbon Steel Tubing Market, By Technology, 2023-2032(USD Billion)

- global Rounds, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Squares, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Rectangles, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Automotive, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Industrial, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Household Equipment, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- global Other, Carbon Steel Tubing Market, By Region, 2023-2032(USD Billion)

- AK Steel: Net Sales, 2023-2033 ($ Billion)

- AK Steel: Revenue Share, By Segment, 2023 (%)

- AK Steel: Revenue Share, By Region, 2023 (%)

- TimkenSteel: Net Sales, 2023-2033 ($ Billion)

- TimkenSteel: Revenue Share, By Segment, 2023 (%)

- TimkenSteel: Revenue Share, By Region, 2023 (%)

- Zekelman Industries: Net Sales, 2023-2033 ($ Billion)

- Zekelman Industries: Revenue Share, By Segment, 2023 (%)

- Zekelman Industries: Revenue Share, By Region, 2023 (%)

- Tenaris: Net Sales, 2023-2033 ($ Billion)

- Tenaris: Revenue Share, By Segment, 2023 (%)

- Tenaris: Revenue Share, By Region, 2023 (%)

- Sandvik Materials Technology: Net Sales, 2023-2033 ($ Billion)

- Sandvik Materials Technology: Revenue Share, By Segment, 2023 (%)

- Sandvik Materials Technology: Revenue Share, By Region, 2023 (%)

- EMJ Metals: Net Sales, 2023-2033 ($ Billion)

- EMJ Metals: Revenue Share, By Segment, 2023 (%)

- EMJ Metals: Revenue Share, By Region, 2023 (%)

- Russel Metals: Net Sales, 2023-2033 ($ Billion)

- Russel Metals: Revenue Share, By Segment, 2023 (%)

- Russel Metals: Revenue Share, By Region, 2023 (%)

- Webco Industries: Net Sales, 2023-2033 ($ Billion)

- Webco Industries: Revenue Share, By Segment, 2023 (%)

- Webco Industries: Revenue Share, By Region, 2023 (%)

- JFE Steel(Chita Works): Net Sales, 2023-2033 ($ Billion)

- JFE Steel(Chita Works): Revenue Share, By Segment, 2023 (%)

- JFE Steel(Chita Works): Revenue Share, By Region, 2023 (%)

- Midwest Tube Mills: Net Sales, 2023-2033 ($ Billion)

- Midwest Tube Mills: Revenue Share, By Segment, 2023 (%)

- Midwest Tube Mills: Revenue Share, By Region, 2023 (%)

- Sharon Tube: Net Sales, 2023-2033 ($ Billion)

- Sharon Tube: Revenue Share, By Segment, 2023 (%)

- Sharon Tube: Revenue Share, By Region, 2023 (%)

- Vallourec: Net Sales, 2023-2033 ($ Billion)

- Vallourec: Revenue Share, By Segment, 2023 (%)

- Vallourec: Revenue Share, By Region, 2023 (%)

- Accu-Tube Corporation: Net Sales, 2023-2033 ($ Billion)

- Accu-Tube Corporation: Revenue Share, By Segment, 2023 (%)

- Accu-Tube Corporation: Revenue Share, By Region, 2023 (%)

Infinitive Data Research provides comprehensive market research, offering in-depth market analysis to help companies understand their target market and industry competition. This research predicts the market acceptance of your brand and products, ensuring informed decision-making for business success.

Competitor Analysis in the Carbon Steel Tubing Industry

Conducting a competitor analysis involves identifying competitors within the Carbon Steel Tubing industry and studying their various marketing strategies. This comparative data allows you to assess your company's strengths and weaknesses relative to competitors, providing insights to enhance your market position.

Importance of Continuous Market Research

Consistently conducting market research is essential for minimizing risk at every stage of business operations. Carbon Steel Tubing market research enables you to collect qualitative and quantitative data, which, when properly analyzed, leads to wise decisions that align with user and customer needs. Below are some crucial lessons learned through the Carbon Steel Tubing market research process:

Key Dimensions of Carbon Steel Tubing Market Analysis

- Trend and Pattern Identification: Analyzing data to spot market trends and patterns.

- Pricing Analysis: Assessing keyword pricing strategies.

- Actionable Insights: Implementing insights derived from data analysis.

- Market Potential: Evaluating the potential of the Carbon Steel Tubing market.

- Competitor Analysis: Studying competitors' strategies and performance.

- Location Analysis: Assessing optimal locations for market penetration.

- Distribution Channels Analysis: Evaluating the effectiveness of distribution channels.

- Market Size and Growth Rate: Measuring market size and growth potential.

- Market Profitability: Assessing profitability prospects.

- Key Success Factors: Identifying critical factors for success.

- Cost Structure: Understanding the cost structure within the Carbon Steel Tubing industry.

Target Audience for the Report

This report is valuable for a diverse audience, including:

- Carbon Steel Tubing Market Manufacturers: To understand market dynamics and enhance production strategies.

- Investors and Financing Companies: To assess investment opportunities and risks.

- Carbon Steel Tubing Market Suppliers: To identify market demands and supply chain efficiencies.

Necessity of the Report

Making Crucial Business Decisions

Understanding the Carbon Steel Tubing market, competition, and industry landscape is vital for making informed business decisions. Without current and relevant market research, decisions may be based on outdated or irrelevant information, potentially harming the business.

Securing Investment Funds

Attracting investors requires demonstrating thorough market research. Investors need assurance that you understand the sector, current and potential competition, and whether your idea addresses a market need.

Identifying New Business Opportunities

Carbon Steel Tubing market research goes beyond understanding trends and consumer behavior. It identifies new revenue streams and opportunities for business pivots. These insights can lead to strategic changes in the business model, promoting growth and adapting to market challenges.

Avoiding Business Failures

Market research also plays a crucial role in risk mitigation. It can reveal when not to pursue certain actions, saving the company from potential losses in revenue, brand image, and more. This proactive approach is often overlooked but is essential for long-term success.

Conclusion

Infinitive Data Research's comprehensive Carbon Steel Tubing market research provides critical insights for making solid business decisions, securing investments, identifying new opportunities, and avoiding potential failures. Understanding market dynamics through continuous research ensures your company remains competitive and thrives in the Carbon Steel Tubing industry.